The 2020s have been a roller coaster so far in the Orange County housing market, as it has been across the nation. From the frenzy of 2021 to the freeze of 2024, buyers and sellers alike have been left wondering what could come next. Fortunately, 2025 can be thought of as a year of recalibration in which buying and selling a home finally began to feel more balanced. To better understand this phenomenon, let’s look at a snapshot of the last five years.

Median sales price

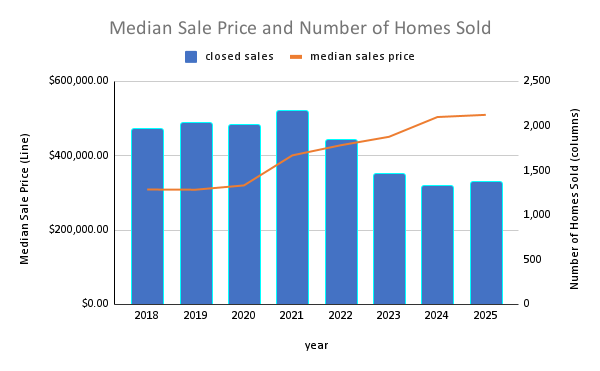

From 2020-2025, the median sales price of homes in Orange County increased a whopping 59%. This growth was concentrated in the period of extremely low interest rates during the COVID-19 pandemic, when annualized home price growth was a staggering 14.75%. When mortgage rates surpassed 7% starting in October 2022 the increase in home prices began to cool. 2025 was the slowest year of the decade so far for home price growth, showing a modest 1.2% gain. This steadying of price growth is one factor helping to restore balance to a previously dizzying market.

Number of homes sold

The housing market in Orange County was also a lot more active during the heart of the COVID-19 pandemic. 2021 was the peak year for sales volume with 2,166 homes sold. But a number of factors, not least among them rising interest rates, led this metric to plummet to its nadir in 2024 when the total number of homes sold fell 39% to 1,325. Put simply, market conditions did not appeal to many buyers and sellers at that time.

A rise in mortgage rates from 3.76% in March 2022 to 7.79% by October 2023 had real life repercussions. If you were to purchase a home at Orange County’s current median home price of $509,750, you would pay over $1,000 extra every month based solely on the interest rate change over that period - a staggering 46% increase in mortgage expenses in a little over a year and a half. Many buyers were priced out of buying a new home and many sellers sat on the sidelines not wanting to let go of the low interest rates they secured during the pandemic. [Mortgage rate data from Freddie Mac and payment data from Zillow Mortgage Calculator]

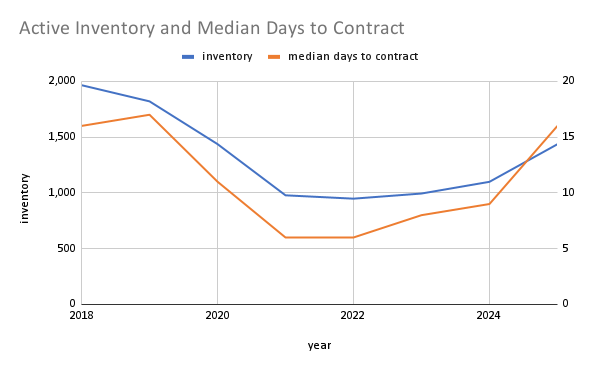

Inventory levels and the time it took homes to sell tell another part of the story. The flood of buyers during the COVID-19 pandemic drove inventory down such that by 2022 it was nearly half of what it had been in 2019. In the same vein, the time it took to go under contract on a home reduced from a median of 17 days on market in 2019 to a mere 6 days on market in 2022. Buyers had very little time to vet a house before putting in an offer and often found themselves in a relentless bidding war.

As mortgage rates increased in 2022 and 2023, buyers and sellers both stepped back - a clear sign of unfavorable conditions in the market. However, home sellers started coming back into the market a little more quickly than home buyers. Housing market supply increased faster than demand, and the time it took to sell a home increased incrementally. Buyers had more homes available to consider and more time to vet homes before putting in an offer to purchase. By 2025, the median days for a home to go from listing to contract was 16 - enough time for an interested buyer to gather information and feel confident in what they are buying, but still a pretty tidy turnaround time for sellers.

Data for closed sales, active inventory and median days to contract, all show the beginnings of a rebound from their lows but have yet to climb to pre-pandemic levels. It appears that the Orange County housing market started to find balance by the end of 2025. If you are considering entering the housing market as a buyer or a seller, your experience in a balanced market like this will be determined largely by pricing; homes priced below their value may still move too quickly for a buyer to book multiple showings before writing an offer, and homes priced above their value may sit on the market for extended periods of time, leading to price cuts and stress for sellers. These data support an optimistic take on what the next state of real estate holds: a balanced market where buyers and sellers have an opportunity to strike a deal that both parties feel good about.

Steven Lambeth is a real estate agent with Weaver Street Realty and will be writing a quarterly article on the housing market for The Carrborean. You can email him at steven@weaverstreetrealty.com with suggestions for future articles or to talk about buying or selling a home.